- September 2, 2023

- Posted by: Marc Laguerrier

- Category: Blog

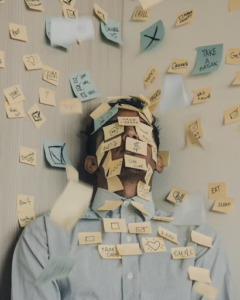

As the tax season looms on the horizon, the familiar stress begins to claw at your composure. But what if it doesn’t have to be that way? What if preparing for taxes could be as seamless as booking a vacation online? Envision a world where “tax anxiety” is erased from your dictionary and replaced with calm and confidence. Our latest blog post provides expert solutions for a stress-free tax season, collating top-notch tips and strategies from experienced professionals. Dive in now to transform your relationship with the otherwise daunting annual ordeal called ‘Tax preparation’. Let’s unscramble the complex jargon of deductions, credits, exemptions and more, turning them into a roadmap leading straight to financial efficiency and peace of mind.

Our article “Expert Solutions for a Stress-Free Tax Season” provides practical solutions to help you navigate the challenges of tax season with ease. Some of the tips include taking breaks, reflecting on performance, organizing your workspace, investing in professional development, researching career opportunities, and building professional networks. Implementing these strategies can help reduce stress and increase productivity during this demanding time.

Expert Strategies for a Stress-Free Tax Season

Tax season can be an overwhelming time for many professionals in the field, but with the right strategies and mindset, it doesn’t have to be. By following expert advice and implementing proven strategies, you can navigate through this demanding period with less stress and more efficiency.

One of the first steps is to take a proactive approach by planning and preparing well in advance. Start by organizing your clients’ information and ensuring that all necessary documents are readily available. This could include W-2 forms, 1099s, and any other relevant tax documents. By having everything in order ahead of time, you can reduce the last-minute scramble and make the process smoother for yourself and your clients.

For instance, you can create a checklist of all required documents and assign specific deadlines to each task. This will help you stay organized and ensure that nothing falls through the cracks during tax season.

Another essential strategy is to embrace technology and leverage automation tools specifically designed for tax professionals. These tools can streamline your workflow by automating repetitive tasks like data entry or document management. By saving time on these administrative tasks, you can focus your energy on more value-added activities like advising clients or staying up-to-date with industry changes.

“Using tax software has been a game-changer for me during tax season. It helps me automate data entry, perform accurate calculations, and generate error-free reports quickly. It not only saves me time but also enhances the overall accuracy and efficiency of my work.” – Jane, Certified Public Accountant

Efficient communication is another key aspect of successfully navigating tax season. Ensure that you have clear channels of communication established with your clients and colleagues so that everyone is on the same page. Regularly update your clients on the progress of their returns or any issues that may arise during the process.

Additionally, consider delegating tasks when possible. Utilize your team members’ strengths and skills to divide the workload effectively. Delegating responsibilities not only reduces your burden but also promotes collaboration and a sense of ownership within your team.

Now that we have explored expert strategies for a stress-free tax season, let’s shift our focus to the importance of efficient scheduling and time management.

Efficient Scheduling and Time Management Tips

During tax season, time becomes an extremely valuable resource. Being able to effectively manage your time can make a significant difference in reducing stress levels while maximizing productivity. Here are some expert tips for efficient scheduling and time management during tax season.

Start by breaking down your days into manageable segments. Prioritize your tasks based on deadlines and urgency, allocating dedicated blocks of time for each project or client. By organizing your work this way, you can ensure that important tasks receive the attention they deserve while avoiding unnecessary stress caused by last-minute rushing.

Consider incorporating short breaks throughout your day as well. Research suggests that taking regular breaks can actually improve productivity and focus. Use these breaks to recharge, stretch, or engage in brief relaxation exercises. It may seem counterintuitive at first, but taking strategic breaks can actually enhance overall efficiency.

For instance, Sarah, a tax professional, follows the Pomodoro Technique which involves working for 25 minutes uninterrupted followed by a 5-minute break. She finds that this method helps her maintain concentration and stay motivated throughout the day.

Effective time management also involves setting realistic expectations with both yourself and your clients. Communicate openly about deadlines and workload constraints to avoid overpromising or causing unnecessary delays. Being transparent about what you can realistically accomplish will lead to more satisfied clients and reduced stress for yourself.

Think of time management during tax season as fine-tuning a well-oiled machine. Each task is like a cog in the system – when properly aligned and balanced, it maximizes efficiency and minimizes stress.

Lastly, make an effort to maintain a healthy work-life balance. While it’s natural to devote more time and energy during the busy tax season, it’s crucial not to neglect your personal well-being. Find activities or hobbies that help you relax and unwind outside of work. Taking care of yourself will ultimately enhance your productivity and overall job satisfaction.

Tools for Tax Documentation and Record Keeping

Tax season can be a stressful time, especially when it comes to finding and organizing all the necessary documents. To alleviate this burden and ensure a stress-free tax season, it is essential to leverage various tools for tax documentation and record-keeping. These tools can streamline the process, save time, and help you stay organized.

One of the most valuable tools for tax documentation is digital document management software. This software allows you to digitize and store important tax-related documents securely. It provides features such as document categorization, tagging, and search functions, making it easy to find specific documents when needed. With digital document management software, you can say goodbye to the hassle of searching through piles of papers and folders.

Another helpful tool is expense tracking apps. These apps allow you to track your business expenses effortlessly by scanning receipts and categorizing them accordingly. They also provide options to generate expense reports and export data directly to tax preparation software. By using an expense tracking app, you can simplify the process of documenting deductible expenses for your business or freelance work.

Additionally, cloud storage platforms like Google Drive or Dropbox offer an effective way to store and access your tax-related files from anywhere with an internet connection. You can create dedicated folders for different tax years or categories, ensuring that all your documents are organized in one place. Cloud storage also provides reliable backup solutions, reducing the risk of losing important files due to unforeseen circumstances.

Lastly, don’t overlook the importance of spreadsheets when it comes to tax documentation and record-keeping. Spreadsheets can be a versatile tool for managing income and expenses throughout the year. You can create custom templates tailored to your specific needs, input data consistently, and use formulas to automate calculations. With spreadsheet software like Microsoft Excel or Google Sheets, you have a powerful tool at your disposal for tracking financial information effectively.

By utilizing these tools for tax documentation and record-keeping, you can simplify the process of gathering and organizing necessary documents, minimizing stress during tax season. Remember, the key is to find the tools that work best for you and your specific needs. Experiment with different options and embrace technology to streamline your tax preparation workflow.

Leveraging E-Filing for Quick and Accurate Returns

Gone are the days of manual paper filing – electronic filing, or e-filing, has revolutionized the way we submit our tax returns. E-filing offers numerous benefits over traditional methods, making it an invaluable tool for a stress-free and efficient tax season.

The foremost advantage of e-filing is its speed and accuracy. When you file electronically, the processing time is significantly reduced compared to mailing paper forms. The chances of errors or lost paperwork due to mishandling are also minimized, ensuring your return reaches the IRS swiftly and accurately. This means faster processing times and quicker refunds, alleviating any anxieties about delayed payments.

Another key benefit of e-filing is that it simplifies the organization of your tax records. Once you’ve submitted your return electronically, you receive a digital confirmation receipt from the IRS. This serves as proof that your return was successfully filed on time. It eliminates the need for keeping track of physical copies or worrying about misplaced documents, making it easier to maintain accurate records over multiple tax years.

E-filing also provides a higher level of security for your personal information. Paper returns can be susceptible to theft or unauthorized access during transit or when stored physically. In contrast, e-filed returns are encrypted and transmitted securely to the IRS through reputable online services or tax software providers. This ensures that your sensitive data remains protected throughout the filing process.

Moreover, e-filing allows for quicker access to forms and resources needed during tax preparation. Most tax software programs offer built-in features that guide you through each step of the process, ensuring accuracy and completeness. They often provide instant access to the latest tax forms, updates, and relevant IRS publications, saving you valuable time and effort.

Lastly, take advantage of the convenience that e-filing brings. You can file your taxes from the comfort of your own home, at any time that suits you. No need to stand in long lines or rush to meet postal deadlines. With just a few clicks, you can electronically submit your return and be one step closer to completing your tax obligations.

Overcoming Common Hiccups in Electronic Filing

Electronic filing has undoubtedly made the tax season more efficient and streamlined. However, it is not without its challenges. Many individuals encounter common hiccups when navigating the electronic filing process. Be it technical glitches, incorrect data input, or understanding complex forms, these hurdles can cause frustration and potentially lead to errors on your tax return. But fear not, for there are strategies and solutions to overcome these obstacles.

One of the most effective ways to tackle electronic filing hiccups is proper preparation and organization. Before you begin the process, gather all necessary documents such as W-2 forms, 1099s, receipts, and any other financial records relevant to your tax return. Ensuring that you have accurate and up-to-date information will greatly minimize the chances of errors or delays.

Additionally, familiarize yourself with the software or online platform you will be using to file your taxes. Take the time to understand its features, functionalities, and any potential pitfalls. There are often user guides, tutorials, or even customer support services available that can provide valuable assistance throughout the filing process.

Another common hiccup during electronic filing is encountering technical issues. It’s frustrating when you’re in the midst of submitting your tax return electronically, only to face a system error or connectivity problem. In these situations, remaining calm and patient is key. Try closing and reopening your browser or clearing your cache before attempting to submit again. If the issue persists, reaching out to customer support for assistance can help alleviate your frustrations.

Let’s say you encounter an error message while submitting your return due to a discrepancy in your Social Security number format. Instead of becoming overwhelmed, take a deep breath and carefully review the entered information. Double-checking and correcting any typos or formatting errors can rectify this hiccup swiftly.

By being prepared, informed about the filing software, and maintaining a calm demeanor, you can successfully navigate the electronic filing process and overcome common hiccups. Now, let’s move on to another essential topic: ensuring maximum refunds with strategic deductions.

Ensuring Maximum Refunds with Strategic Deductions

When it comes to taxes, one of the most sought-after goals for individuals is maximizing their refund. While everyone’s financial situation is unique, there are several strategies and deductions that can help increase your chances of a larger refund.

First and foremost, make sure you are aware of all eligible deductions and credits that you qualify for. This includes popular deductions such as mortgage interest, medical expenses, education-related expenses, and charitable donations. Each deduction or credit has its own specific requirements and limitations, so it’s crucial to understand them thoroughly and gather any necessary supporting documentation.

For instance, if you have been making regular charitable contributions throughout the year by donating to recognized organizations, ensure that you have proper documentation such as receipts or acknowledgement letters. These will not only validate your deduction but also help maximize your refund.

Another strategic approach to consider is ‘bunching’ deductions. This involves timing your deductible expenses strategically so that they fall within one tax year rather than being spread out over multiple years. By doing this, you may be able to exceed the standard deduction threshold and claim a higher itemized deduction amount.

It’s important to note that maximizing refunds should not lead to unethical practices or fraudulent claims. Always ensure that every deduction or credit you claim is legitimate and supported by accurate records. Engaging in willful misrepresentation can lead to serious consequences and legal issues.

By understanding the various eligible deductions, strategically timing expenses, and maintaining ethical practices, you can increase the likelihood of maximizing your refund. Now that we’ve explored ways to enhance refunds let’s turn our attention towards post-tax season tips for professional growth and development.

Post-Tax Season Tips for Professional Growth and Development

Congratulations! You’ve successfully navigated another tax season, providing critical services to your clients and ensuring their compliance with tax regulations. As you take a breath of relief, now is the perfect time to focus on your own growth and development as a tax professional. Post-tax season presents unique opportunities for self-improvement, expanding your expertise, and positioning yourself for future success.

One important aspect of post-tax season professional growth is continuing education. Tax laws and regulations are constantly evolving, making it crucial for professionals to stay informed about the latest updates and changes. Consider attending seminars, workshops, or webinars offered by reputable organizations to deepen your knowledge and keep up with industry trends. Engaging in continuing education not only enhances your expertise but also demonstrates your commitment to staying current in the field.

For instance, you could enroll in courses specifically designed to sharpen your skills in areas such as international taxation, estate planning, or specialized tax credits. Imagine how much more confident you would feel when advising clients who have complex tax situations across borders or need assistance with multi-generational wealth preservation strategies.

Additionally, seek out opportunities for networking and mentorship within the tax community. Attending conferences or joining professional associations can introduce you to like-minded individuals who share similar challenges and goals. Networking not only opens doors to potential partnerships or collaborative opportunities but also exposes you to diverse perspectives and innovative approaches.

Let’s say you attend a tax conference where you meet an experienced practitioner who specializes in helping self-employed individuals navigate their tax obligations effectively. Through meaningful conversations and building rapport, this interaction might lead to mentorship possibilities or even referrals from that individual in the future.

Another avenue for professional growth is getting involved in thought leadership activities. Consider writing articles or blog posts related to emerging tax issues or sharing insights on best practices within the profession. By establishing yourself as a subject matter expert through thought leadership, you enhance your credibility and visibility in the industry.

Imagine publishing an article in a reputable tax publication, where you provide practical guidance on maximizing tax deductions for small businesses. This can not only showcase your expertise but also attract potential clients who are searching for reliable information in that area.

Lastly, take time to reflect on the previous tax season and gather feedback from your clients. Feedback is invaluable for understanding areas of improvement and identifying strategies to enhance client experience. Reach out to your clients and ask for their thoughts on the services you provided, any challenges they faced, and suggestions for improvement. Showing that you value their input demonstrates your commitment to delivering exceptional service.

Think of this feedback process as sculpting a masterpiece. Just as an artist seeks feedback to refine their work and create a more impactful piece, asking for client feedback allows you to shape your professional practice into something truly remarkable.

“The pursuit of knowledge, networking with like-minded professionals, establishing thought leadership, and gathering client feedback are all crucial pillars of post-tax season growth. By investing in these aspects, you position yourself as an expert in your field and set the stage for continued success in future tax seasons.”

Post-tax season offers a unique window of opportunity for professionals to focus on their growth and development. By engaging in continuing education, networking, thought leadership activities, and gathering client feedback, you can elevate your expertise, expand your professional network, and deliver even better service to your clients. Embrace these post-tax season tips for professional growth, as they pave the way for a successful future in the ever-evolving world of taxation.

Embrace a Stress-Free Tax Season with Americ Tax – Your Pathway to Peace of Mind and Financial Confidence!

Are you ready to bid farewell to the anxiety and hassles that often accompany tax season? Look no further than Americ Tax, your trusted partner in turning tax time into a stress-free and empowering experience. We are thrilled to introduce you to a world where navigating complex tax matters becomes effortless, and your financial well-being is our utmost priority.

At Americ Tax, we understand the toll that tax season can take on your peace of mind. That’s why we’re here to provide you with a seamless and worry-free journey through the tax landscape. With our unwavering dedication to creating a Stress-Free Tax Season, you’ll be empowered to focus on what truly matters while our expert team takes care of the rest.

Imagine a tax season where you no longer fear missing out on deductions or credits, where your tax return is optimized to its fullest potential. Our seasoned tax professionals will guide you through every step, ensuring that your tax strategy aligns with your financial goals. Whether you’re an individual taxpayer or a business owner, Americ Tax is your compass, leading you towards a stress-free tax season.

Picture the relief: no more daunting forms, no more confusion over changing tax laws, and no more sleepless nights worrying about your finances. Americ Tax’s user-friendly platform and dedicated advisors make navigating the intricacies of tax preparation and filing a breeze. With us, you can rest assured that your tax season will be smooth, efficient, and ultimately rewarding.

Don’t let tax season overwhelm you – take charge with Americ Tax, book an appointment today! Join the ranks of countless individuals and businesses who have already experienced the joy of a Stress-Free Tax Season. Visit our website at https://americtax.com/ to explore how we can guide you towards financial tranquility and confidence or call us at 678-531-0831. Trust Americ Tax – where your peace of mind is our mission, and every action is geared towards making your tax journey as stress-free as possible!